White collar crimes were named after the participants of these crimes, who were usually senior executives and used to wear white shirts. The term was coined by Edwin Sutherland in 1939. He defined white collar crime as “crime committed by a person of respectability and high social status in the course of his occupation”. He further explained that white-collar criminals had different characteristics and motives than typical street criminals. These crimes include embezzlement, swindle, cheating consumers, fraud and dishonest schemes, but do not exclude many other similar dishonest tactics. Corporate crimes resemble the white-collar crimes as the corporations may involve in cyber crime, embezzlement, fraud, copyright infringement and money laundering. The difference between a white collar crime and a corporate crime is that an individual benefits in the former case, while a corporation benefits in the later case. According to the FBI and the Association of Certified Fraud Examiners, the annual cost to the United States on account of white collar crimes exceeds $600 billion.

1. ImClone stock trading case

Erbium was an experimental product of ImClone Company. The product failed to get approval of the FDA, and consequently the stock prices of ImClone declined sharply on December 28. The U.S. Securities and Exchange Commission later on revealed that prior to declaring the FDA decision, many of the company executives sold their stocks. The founder of ImClone, Samuel D. Waksal, was arrested in 2002 on the charges of inside trading, as he had instructed his family and friends to sell the stocks prior to declaring the FDA’s decision. Waksal’s daughter Aliza Waksal sold $2.5 million in stocks, while his father Jack Waksal sold $8.1 million between 27th and 28th December, 2001. Waksal pleaded guilty to securities fraud and was sentenced to seven years and three months imprisonment, on June 10, 2003.

2. Jeff Skilling Case

Jeff Keith Skilling, better known as Jeff Skilling, was born on November 25, 1953 in Pittsburg, Pennsylvania. He was an MBA from Harvard Business School and was the youngest partner of McKinsey & Company. Formerly he served as president of Enron Corporation, headquartered in Houston, Texas. On August 14, 2001, he resigned unexpectedly on personal grounds. In December 2001, the company declared bankruptcy, which was considered the largest in the history of the United States. More than 20,000 employees lost their jobs, many lost their life savings, and investors lost billions. Skilling was convicted of multiple felony charges and is serving 24 years and four months imprisonment at the Federal Correctional Institution.

3. Ponzi Scheme

Carlo Pietro Giovanni Guglielmo Tebaldo Ponzi, commonly known as Charles Ponzi, was born on March 3, 1882 in Lugo, Emilia-Romagna, Italy and died on January 18, 1949 at the age of 66 years in Rio de Janeiro, Brazil. In the 1920s, he was known as a swindler on account of his money-making scheme. He promised his clients 50% profit within 45 days or 100% profit within 90 days. He used the last client’s money for the purpose. This type of scheme is known as a Ponzi scheme. The money invested in his schemes was enough to cover 160 million postage coupons but only very little was in actual circulation. Ponzi’s clients lost more than 20 million dollars in 1920. He spent most of his life in prison and died in poverty.

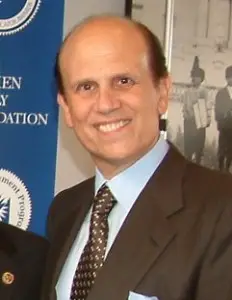

4. Junk Bonds case

Michael Robert Milken was born on July 4, 1946 in Encino, California, U.S. He is an American financier and is known for developing high yield bonds, which are also known as junk bonds. He was indicted on charges of felony and for violating U.S. Securities laws. He was sentenced to ten years imprisonment, which was later reduced to two years on account of his good behavior and cooperation with the authorities in tracing the involved persons. He was fined $600 million and was barred permanently from the securities industry by the Securities and Exchange Commission.

5. Jack Abramoff

Jack Abramoff was born on February 28, 1958 in Atlantic City, New Jersey. He is a former American lobbyist, who was involved in a big corruption investigation which ended in the conviction of twenty-one people, including some White House officials. Abramoff pleaded guilty to three felony charges including fraud, tax evasion, and conspiracy. He defrauded Native American tribes. He told the prosecutors that a senator asked him for a contribution of $30,000 in exchange for extending him assistance in matters relating to Indian casinos. After pleading guilty in the Indian lobbying scandal and dealing with Sun Cruz Casino, he was sentenced to six years imprisonment.

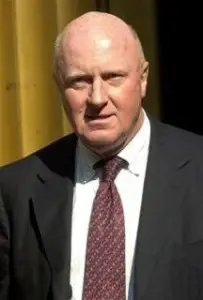

6. Tyco International Case

Leonard Dennis Kozlowski was born to Agnes and Leo Kelly Kozlows on November 16, 1946 in Newark, New Jersey. He was the former CEO of Tyco International, which was a Swiss Security Systems Company incorporated in Switzerland and which had U.S. operational headquarters in Princeton, New Jersey. In 2005, he was convicted of crimes relating to his receiving $18 million in unauthorized bonuses, the purchase of art for $14.725 million, and for making a payment, worth $20 million, by Tyco as an investment banking fee to Frank Walsh, who was a former director of Tyco. Judge Michael Obus of the Manhattan Supreme Court sentenced him on September 19, 2005 to serve minimum eight years and four months in prison for his role in the scandal.

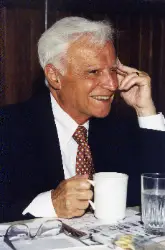

7. Adelphia Frauds

John Rigas was born to James and Eleni Rigas on November 14, 1924 in Wellsville, New York. Borrowing money from his friends, he purchased a theater in Coudersport, Pennsylvania, in 1951. Afterwards, he purchased the town’s TV cable television. He expanded his network under the Adelphia, covering 5.6 million customers in thirty states. In May 2002, he was indicted for securities fraud, bank fraud and wire fraud. Along with other executives, he robbed the corporation of $2.3 billion in liabilities by concealing from corporate investors. He was convicted of the charges of fraud and conspiracy on June 27, 2005 and was sentenced to 15 years imprisonment.

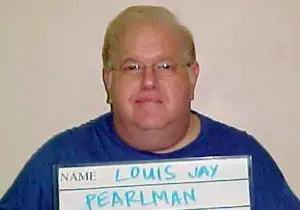

8. Pearlman Ponzi Schemes

Louis Jay Pearlman, commonly known as Lou Pearlman, was born on June 19, 1954. He was raised in Flushing, Queens. Making use of his cousin Garfunkel’s fame, he started a musical band but did not succeed in it. Then he started a helicopter taxi company after convincing a German investor to fund him. He prepared a Ponzi scheme and defrauded investors by creating a fictitious airline and depriving the investors of their $300 million. He started living a lavish life style. After his frauds were known, he tried to escape, but was caught in Indonesia. In 2008, he was convicted of conspiracy, money laundering and fraud and was sentenced to 25 years in prison.

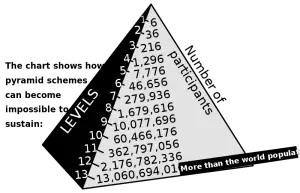

9. Pyramid Scheme

Norman Yung Yuen Hsu was a Chinese man born in October 1951. He was convicted of fraud by pyramid scheme. It is a non-sustainable business model in which the participants are promised to be paid for enrolling other participants and not for any real investment. He associated himself with the garments industry and also acted as fundraiser for the Democratic Party. He was a fugitive from a 1992 fraud conviction and after being exposed in 2007 fled California. On November 27, 2007 a federal grand jury indicted him for the violation of federal Campaign Laws and depriving the investors of $20 million by fraud.

10. Tom Petters Hedge Fund Fraud

Thomas Joseph Petters was born on July 11, 1957 in St. Cloud, Minnesota, U.S. He worked in Colorado as a regional manager of an electronics store and bought its three locations in Colorado and Kansas after the company went bankrupt. In 2001 he started Redtagbiz.com, an on-line store, selling more than $1 billion in 2001. Between 2001 and 2008, he raised more than $4 billion through Ponzi schemes. He was involved in the third largest hedge fund fraud in the U.S. history. Hedge funds are privately managed investment funds through which he raised funds beyond the permissible limits. The U.S. District Court in St. Paul, Minnesota found him guilty on 20 accounts of wire mail fraud and conspiracy. He was sentenced to fifty years imprisonment in April, 2010.

Conclusion

White collar crimes are usually non-violent crimes intended for illegal financial benefit. Unlike blue collar crimes like shoplifting, which are visible and come to the notice of the law enforcement agencies instantly, white collar crimes are not that visible and escape being noticed for long periods. White collar crimes are punishable by imprisonment, fines, probation, community service etc. Following the Enron Scandal, the Sarbanese-Oxley Act was passed in 2002 by the United States Congress and made into law by President George Bush. That the white collar crime are non-violent is in fact often a misconception as their repercussions are far reaching and fatal in many cases. In China a white collar crime is even punishable by death.

Leave a Reply